Introducing MaticX: Stader’s Liquid Staking Solution Coming to Polygon

Home

Blogs

Polygon

Introducing Mat...

Introducing MaticX: Stader’s Liquid Staking Solution Coming to Polygon

As discussed in our vision with Staking on Polygon here, Stader is launching Liquid Staking for MATIC very soon.

In this article, we will discuss:

- What is MaticX?

- How MaticX Works?

- Decentralization

- Security

- Launch

What is MaticX?

Users will have the ability to stake their MATIC through Stader’s dapp.

When a user stakes with Stader, they will mint a new liquid token — MaticX .

The liquid token enables a broad set of possibilities:

- ~8.5%+ APY: MaticX will deliver maximum staking rewards on the staked Matic

- DeFi Interoperability: MaticX’s token design allows for easy integration with all types of DeFi prtocolos — from DEXs to Lending/ Borrowing protocols to Yield Optimizers (from vaults to auto-compounders to leveraged yield farming).

- Liquidity Pools: Matic <> MaticX liquidity pools on top DEXs will enable users to provide instant liquidity to users who want to exit their MaticX positions.

How MaticX Works?

MaticX will be a Token that increases in value relative to Matic as staking rewards accrue.

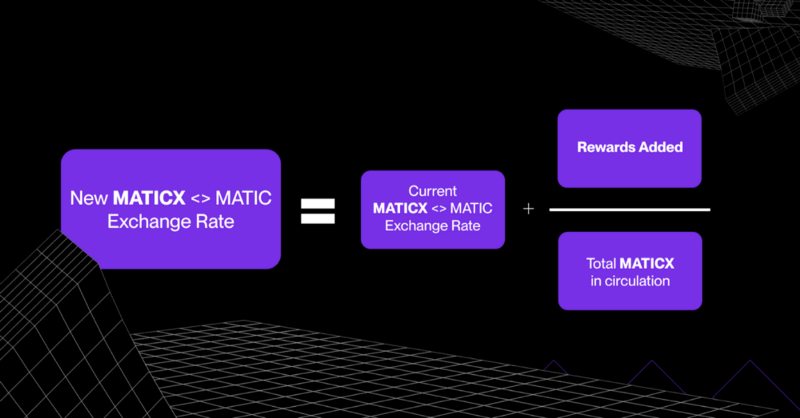

Every time staking rewards are added to the pool the MaticX: MATIC exchange rate will increase using this formula:

The MaticX: MATIC exchange rate will be initialized as 1 at the start of the contract.

When users stake MATIC, they will mint MaticX at the prevailing exchange rate. During an unstake operation, MATIC will be given back to the user at the prevailing exchange rate while the MaticX will be burned.

Decentralization

When you stake with Stader, your assets are automatically distributed across a carefully chosen set of validators. This furthers Polygon’s decentralization while minimizing risks.

Stader enables single-click staking with a carefully curated pool of validators. More details on the validator selection criteria coming soon!

Security

At Stader, the security of our smart contracts and, hence, the safety of user’s funds is one of our top priorities. We are currently undergoing 2 third-party audits and our code will be vetted by launch.

Launch

We are going into beta in the next few days.

Our official launch will be next week — getting us started on this liquid staking revolution on Polygon!

Please join our launch by following us on Twitter for exclusive launch updates!

By:

Stader Labs

Join Stader’s newsletter

Get the latest updates, new DeFi strategies and exclusive offers right in your email box

Analytics

© Copyright 2023 Stader. All rights reserved.