Stader Completes a Strategic Private Sale of $12.5m

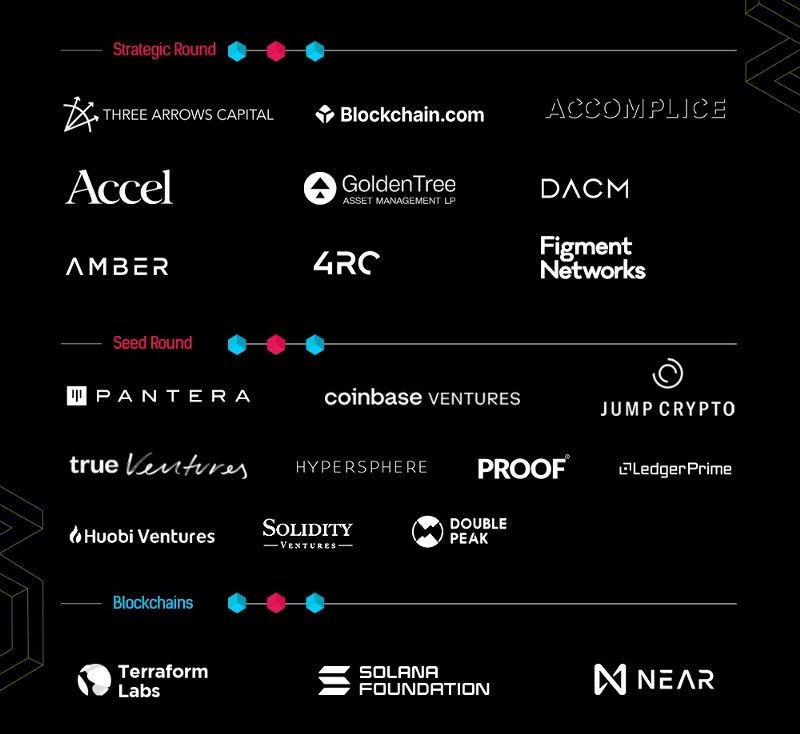

After raising $4 million from Pantera, Coinbase Ventures, Jump Capital, True Ventures, Hypersphere, Proof, Ledger Prime, Huobi Ventures…

After raising $4 million from Pantera, Coinbase Ventures, Jump Capital, True Ventures, Hypersphere, Proof, Ledger Prime, Huobi Ventures, Solidity Ventures and Double Peak, we at Stader are taking it a step further.

We’ve raised $12.5 million via a strategic private sale. Three cheers to that!

Three Arrows Capital led the sale with participation from Blockchain.com, Accomplice, DACM, GoldenTree Asset Management, Accel, Amber, 4RC, Figment and marquee angels including Matt Cantieri, GM at Anchor Protocol and Prabhakar Reddy, Co-founder of FalconX.

The Present and The Future

Stader already plays a critical role in helping PoS networks decentralize, thanks to our staking infrastructure that makes it easy for delegators to stake with a basket of validators.

Our two core products — Stake Pools, where users can safely and easily stake in pre-defined baskets of validators grouped by performance and several other attributes, and Liquid Staking, where users receive a liquid token (LunaX) when staking to participate in yield-boosting DeFi strategies — form the cornerstone of our solutions.

Since we launched in November 2021, over 20,000 unique wallets are staking over 6 million LUNA with a total value locked of around $500 million. This clearly shows the traction that we have garnered and the market opportunity in staking.

Apart from Terra, Stader’s native modular smart contracts will soon support multiple chains, including Solana, Ethereum, Fantom, Hedera, and Polygon. The idea is to build an economic ecosystem that will enable growth and development of custom solutions such as yield redirection with rewards, liquid staking, launchpads, gaming, and more.

These tools will help Stader achieve the vision to be the most convenient and safe non-custodial staking platform and an integral ally in the future of finance.

Tokenomics (incl. Supply and Distribution)

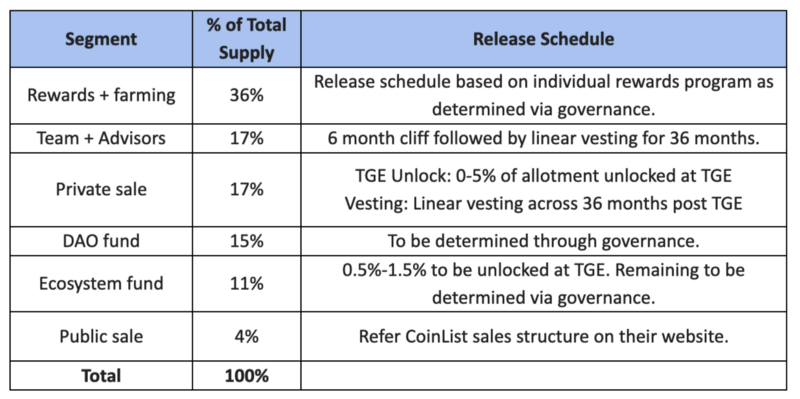

Several community members have asked us to share details about our token distribution and vesting. The total supply of Stader tokens will be limited to 150 million.

The distribution of Stader tokens has been planned to incentivize strategic partners, community, users to own a majority of the network while also reserving a suitable portion of Stader tokens to incentivize third parties to build on the Stader platform.

Below table outlines the Token distribution and release schedule across different buckets.