Introducing Stader Labs

At Stader, our mission is to simplify staking & offer the best risk-adjusted returns to delegators. We imagine a future where our DeFi…

Introducing Stader Labs

At Stader, our mission is to simplify staking & offer the best risk-adjusted returns to delegators. We imagine a future where our DeFi building blocks on staking unleashes a new world of staking derivatives.

In the long run, Stader would be a platform for DAOs and developers to build their custom staking solutions consisting of chosen validator pools, Staking-based cross-asset ETFs (equivalent to an S&P 500 index that additionally pays out interest).

State of Staking:

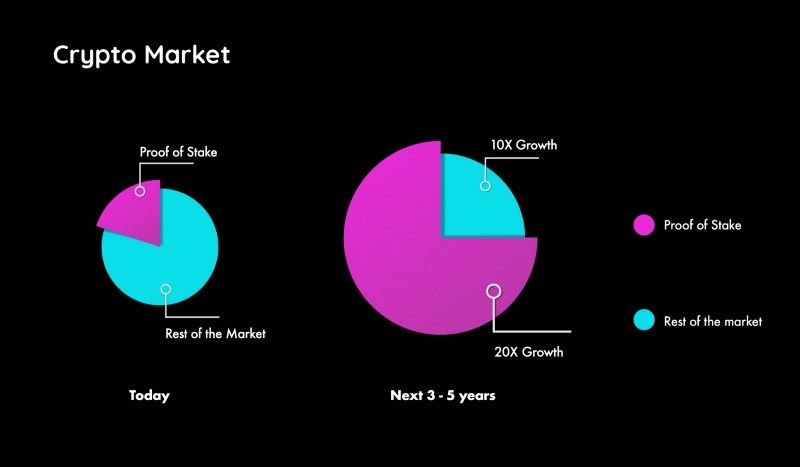

Let’s take a look at a few statistics about Proof-of-Stake (PoS) networks and Staking. The total market-cap of PoS tokens is $400B (including Ethereum), and the capital staked in these networks is ~$150B.

At Stader, we believe that

- PoS networks will grow at a much faster pace than the rest of the crypto market and within a short period, PoS networks will come to dominate the market cap of all digital assets

- Staking is a fundamental component of a PoS network. The capital staked acts as direct security against any attacks on the network. In other words, staking is here to stay

- With the introduction of staking pools, delegation, and rewards incentives — networks have made mass adoption of staking possible

Problems with delegation:

Token Delegation has been growing in popularity. However, there are three significant problems delegators face.

- Node selection: There is limited information available about the nodes and their performance. Most delegators don’t understand the complex performance metrics and risks of staking

- Node monitoring and re-delegating: Delegators monitor validators’ performance, often reacting to unsatisfactory validator performance by re-delegating to new validators. This is a tedious process

- Reward Monitoring and Redemption: Delegators have to invest significant effort in tracking, monitoring, and re-staking their rewards. Imagine holding more than 10 PoS positions, each across five validators, and having to readjust your portfolio for the next five years constantly

How do we at Stader plan to solve this:

There can be multiple solutions to this problem, like adding insurances to the pools, curating a few nodes, and spreading the delegated capital across them. However, we think delegator first, and this drives our strategy and product at Stader. Our meticulous research has given us critical insights into the significant delegator segments and their needs, as mentioned below.

Key insights:

- About 80% of the delegators we interviewed mentioned staking is tedious and time-consuming today, and they would use a solution that simplifies staking for them

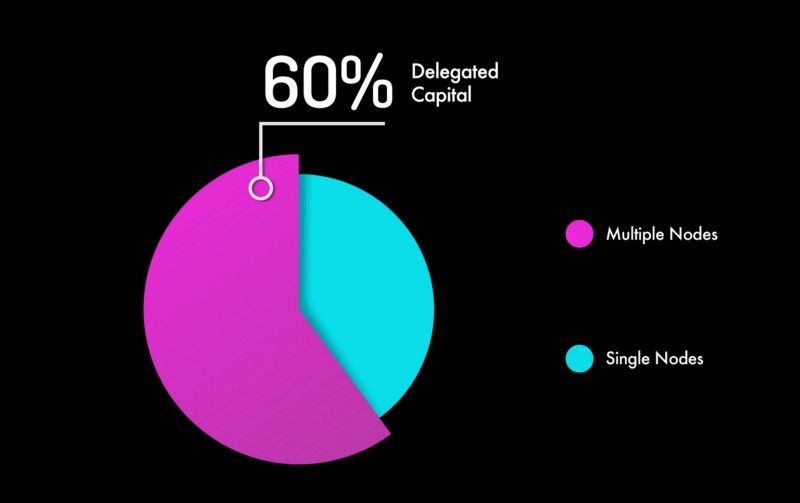

- About 60% of delegated capital is spread across multiple nodes, with more than a third of the delegators doing this to de-risk validator performance inconsistencies

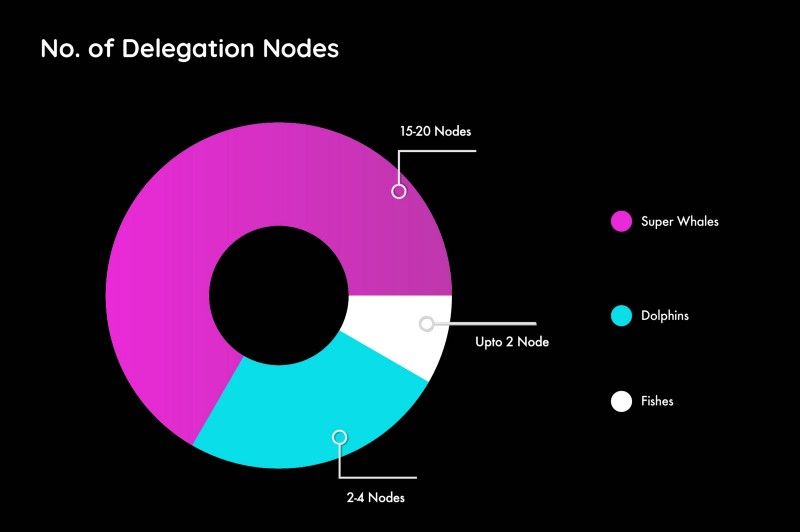

Multiple segments within the delegator community operate differently.

- Super Whales & Whales: Constitute 10–20% of the delegators and 40–50% of the capital delegated. They typically spread their delegations across more than five nodes and up to 15–20 nodes. Maximizing risk-adjusted returns is their goal. A good proportion of them wants to promote decentralization hence delegate to multiple nodes

- Dolphins: Constitute 30% of the delegators. Spread their delegation across 2–4 nodes. Multiple segments exist within this group. Some are sensitive to node commissions and switch to lower-cost nodes. Some want to delegate to the most popular/ stable nodes. Some want to promote decentralization by staking with upcoming/ smaller nodes

- Fish: Typically spread their stake to max two nodes. They want to spread it to multiple nodes, but gas costs could be prohibitive. They are sensitive to commissions and often switch to lower commission nodes

Building on our insights, we are creating a platform that does end-to-end stake management for delegators. Below are the core guiding principles for our platform:

- Empower delegators to make the right delegation decision (i.e., choosing nodes/ node pools) based on their preferences

- Improve delegator UX/UI through custom products, tools, and interfaces for smart-delegation, governance, and rewards management (i.e., reduce 95% of the effort)

- Generate best risk parity yield on staking rewards and liquidity on staked assets by providing access to original and curated cross-chain lending protocols, liquid staking derivatives, gamified staking pools (think Pool together on staking), and future reward swaps

Conclusion:

In this article, we have introduced the problems we are solving for delegators at Stader Labs. We will publish a series of articles over the next few weeks explaining our strategy and vision. Be on the lookout for the various products we are building, tokenomics, and our philosophy for decentralization. Please subscribe to stay tuned. You can also reach out to us on telegram, twitter or email.