Introducing LunaX

The purpose of this article is to share further details about our most awaited Liquid staking token (LunaX). Read on to learn more about our launch plan

The purpose of this article is to share further details about our most awaited Liquid staking token (LunaX). Read on to learn more about the mechanism, key applications and launch plan.

Key sections and details below:

- A Staking launch like never before

- Building solutions for every segment

- Introducing LunaX — Xtreme Liquidity

- LunaX Mechanism

- Key Applications — Earning Xtra

- Launch

1. A Staking launch like never before

We are extremely thankful to #Lunatics for the massively successful launch of Plain Staking/Stake Pools on Stader, where over 6800 users have already staked with us in less than a week. Currently, the TVL on Stader is 3.8 Million Luna (200 Million UST).

Hundreds of you have been asking us daily “Wen Liquid token?”

Read through to learn more about LunaX.

2. Building solutions for every segment

While our Plain Staking product serves the needs of users who plan to hold the asset for a very long-term, don’t need immediate liquidity & further intent/ mandate to participate in DeFi.

We understand that there are a few user segments that would prefer the following:

- Instant liquidity: Ability to exit their staked asset position immediately

- Enhanced yields: Opportunity to maximise yields while earning staking rewards and air drops

Liquid staking tokens provide a solution to the above mentioned opportunities by tokenizing the staked assets.

3. Introducing LunaX — Xtreme Liquidity

LunaX is a liquid staking token by Stader that enables instant unlocking of staked Luna & opens up possibilities across DeFi protocols.

With LunaX, users can have the following benefits:

- Auto-compounding Luna and stable coins (after conversion to Luna)

- Continue to earn airdrops (based on weekly snap-shots taken randomly)

- Instant liquidity and yield enhancing opportunities

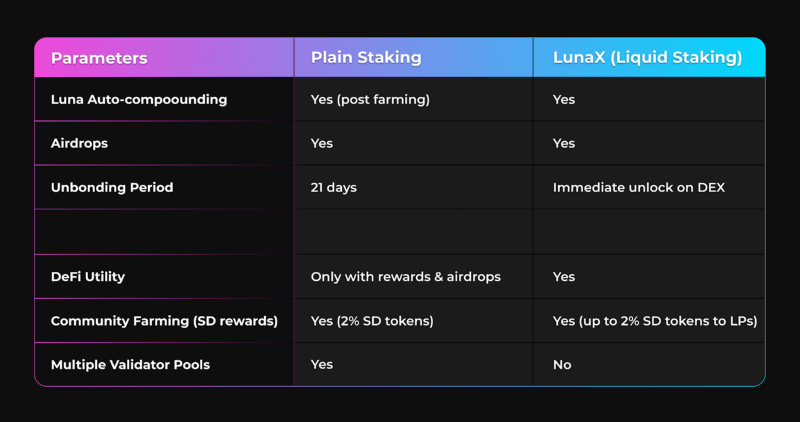

Here is a quick comparison of Liquid and plain staking:

4. LunaX Mechanism

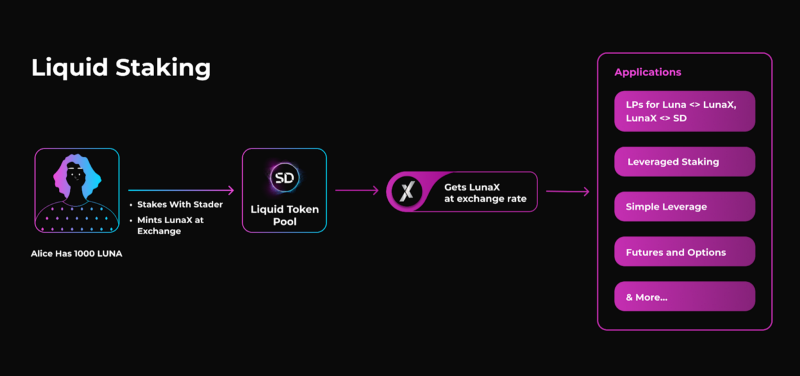

LunaX is an auto-compounding accrual token (like aUST) that can be minted when users stake with Stader using the liquid staking pool. Here’s a look at the key mechanisms across the life-cycle of LunaX.

1. Minting: Users can mint LunaX by staking with the Stader liquidity pool.

2. Value Accrual & Slashing:

2.1 Accrual:

- The rewards generated on the staked Luna (including stablecoins) would be restaked at regular intervals (24 hr to begin with).

- As the rewards accrue, there is no increase in the LunaX supply, hence the price of LunaX goes up with respect to Luna

2.2 Slashing:

In the event of slashing, LunaX supply remains the same but the price goes down as the quantity of Luna staked will decrease.

3. Airdrops to LunaX: Weekly snapshots will be taken at a random time & all holders of LunaX would be allocated protocol airdrops like ANC, MIR, VKR, MINE etc.

4. Burning: Users can burn LunaX and unstake Luna at the current exchange rate for a small withdrawal fee. Details to be shared soon.

5. Key Applications — Earning Xtra

LunaX opens up a new world of opportunities for Luna holders.

During Community Farming:

- Liquidity Pools: Similar to other tokens, LunaX would also have liquidity pools. By providing liquidity, users will receive:

1- SD token rewards

2 - Swap fees

3 - Additional DEX incentives (if any)

We are working with several protocols on Terra to unlock several yield enhancement opportunities for LunaX.

Future Applications:

- Leveraged Staking: Leverage LunaX to borrow Luna several times and earn staking rewards and air drops proportional to the number of times leverage (based on LTV).

- Simple Leverage: Leverage LunaX to borrow UST or any other asset.

- Futures and Options on LUNA: Several futures and options can be built on top of LunaX. E.g. Shorting Luna to speculate on Luna price while earning staking rewards and air drops

- Cross-Chain Compatibility: Since LunaX is an accretive token, it will be cross chain compatible.

- Anchor Integration: In future, potential Anchor integration (if governance voted) by converting LunaX to bLunaX (separation of rewards into separate contract, use bLunaX as collateral on Anchor)

6. Launch

Our Liquid Staking/LunaX contracts are undergoing an audit right now and are expected to be done by the 1st week of December (slight delay due to Thanksgiving weekend). We have tested the contracts internally and are confident about the security and safety. Will share further details regarding LunaX launch date very soon.

After the full audit, LunaX will be launched with Community Farming. Up to 2% of SD tokens (3 Million SD tokens) would be available for liquidity providers during the 2 month period of community farming.

Here’s how you can participate:

- During community farming for LunaX, a user can stake with Stader Liquid staking pool and mint LunaX at the prevailing exchange rate on Stader.

- To farm SD tokens users need to provide liquidity for the LunaX <> Luna LP pool on Terraswap initially. Additional pools will be created on other DEXs.

- SD tokens will be farmed by LP providers daily for the first 2 months after the farming begins.

Farmed SD tokens will be vested over a period of 6 months (similar to Plain Staking) & there are no withdrawal fees for LP providers.

Stay tuned for further updates.