BNBx-Rewards Explained

Stader’s Liquid Staking Solution for BNB

Stader’s Liquid Staking Solution for BNB

$BNB holders can now seamlessly earn staking rewards on their tokens without the need for understanding validator performance or locked tokens.

Stader will soon launch BNBx, a liquid token that you can mint when you stake your $BNB with us. As staking rewards accrue, BNBx will grow in value as compared to BNB, let us take a deeper look at the BNBx rewards structure

Diving Deep into the Rewards Structure

Let’s take a look at a few key terms before we get into how BNBx works and what the reward structure entails.

· Stake Pool TVL (Total Value Locked): Stake Pool TVL (or just TVL) is the amount of BNB in the Stader staking smart contract. This includes all the BNB staked with Stader, plus the cumulative rewards to date, minus any withdrawals through unstaking.

· APY: It is the annualized rate of rewards added to the Stake Pool TVL per epoch.

Note — APY is dynamic and does not guarantee a fixed rate of return for the full year, it depends on the returns offered by various validators on the network.

How does BNBx work?

When users stake BNB, they will mint BNBx at the prevailing exchange rate.

Stader then takes the BNB deposited by users and stakes them optimally across various validators on the network. To know more about how Stader optimizes validator selection, see here. As these validators process transactions they generate rewards which are funneled back into the staking pool by Stader increasing the value of the BNBx in circulation

Thus, BNBx is a reward-bearing liquid token i.e. the value of 1 BNBx token vs. BNB increases over time as staking rewards accumulate.

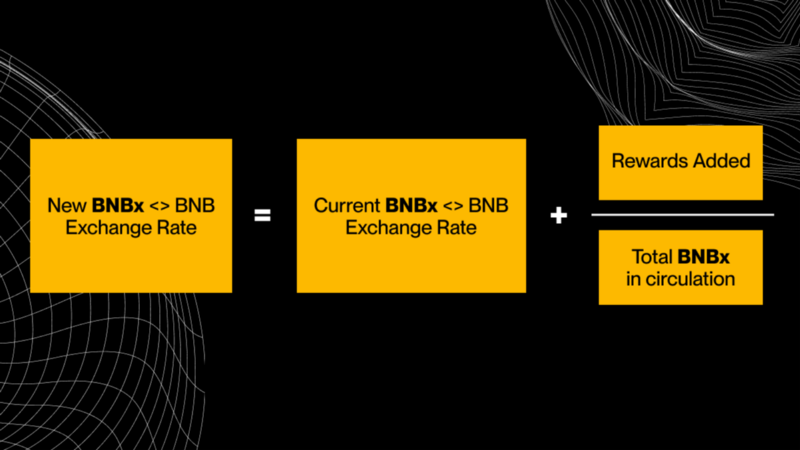

How is the BNBx <> BNB Exchange Rate Determined?

The BNBx: BNB exchange rate will be initialized as 1 at the start of the contract.

Every time staking rewards are added to the pool, the BNBx<>BNB exchange rate will increase using this formula:

New BNBx<>BNB Exchange Rate = Current BNBx<>BNB Exchange Rate + (Rewards Added/Total BNBx in circulation)

What fees can one expect to incur when staking BNB with Stader?

There are various types of fees that will be incurred for BNB staking operation, below is an indicative list of the same.

· Transaction Fee: A transaction fee is charged by the Binance network for various transactions done with the Stader smart contract. Stader has no control over this fee rate nor does it receive any part of this fee.

· Rewards Fee: You never pay commission on staked BNB but only on earned staking rewards (Stader makes revenue only when you gain!).

So what are you waiting for?

Start earning those juicy yields by staking BNB with us and deploy your BNBx on DeFi protocols to earn more yields on top of the staking rewards.

Note — The calculations above are conceptual only and may differ slightly in practice.

To stay updated about our launch and more developments, please follow us:

For a chance to win 1000 BUSD, be part of our exclusive Alpha group here

#BNB #Binance #BNBChain #DeFiNews #BSCGems #crypto #cryptonews