Understanding rsETH | Tech Explainer

Introduction

The team at Stader introduced and popularized the concept of a liquid restaked token (LRT). At its core, an LRT is a liquid token that offers liquidity to illiquid assets deposited into restaking platforms, such as EigenLayer. rsETH is already live on testnet. As we continue to build this out, here’s a quick primer on the tech that powers it.

What is rsETH?

rsETH is a liquid restaked token that allows users to receive Ethereum staking and restaking rewards while retaining liquidity and the ability to participate in DeFi.

What is the tech behind rsETH?

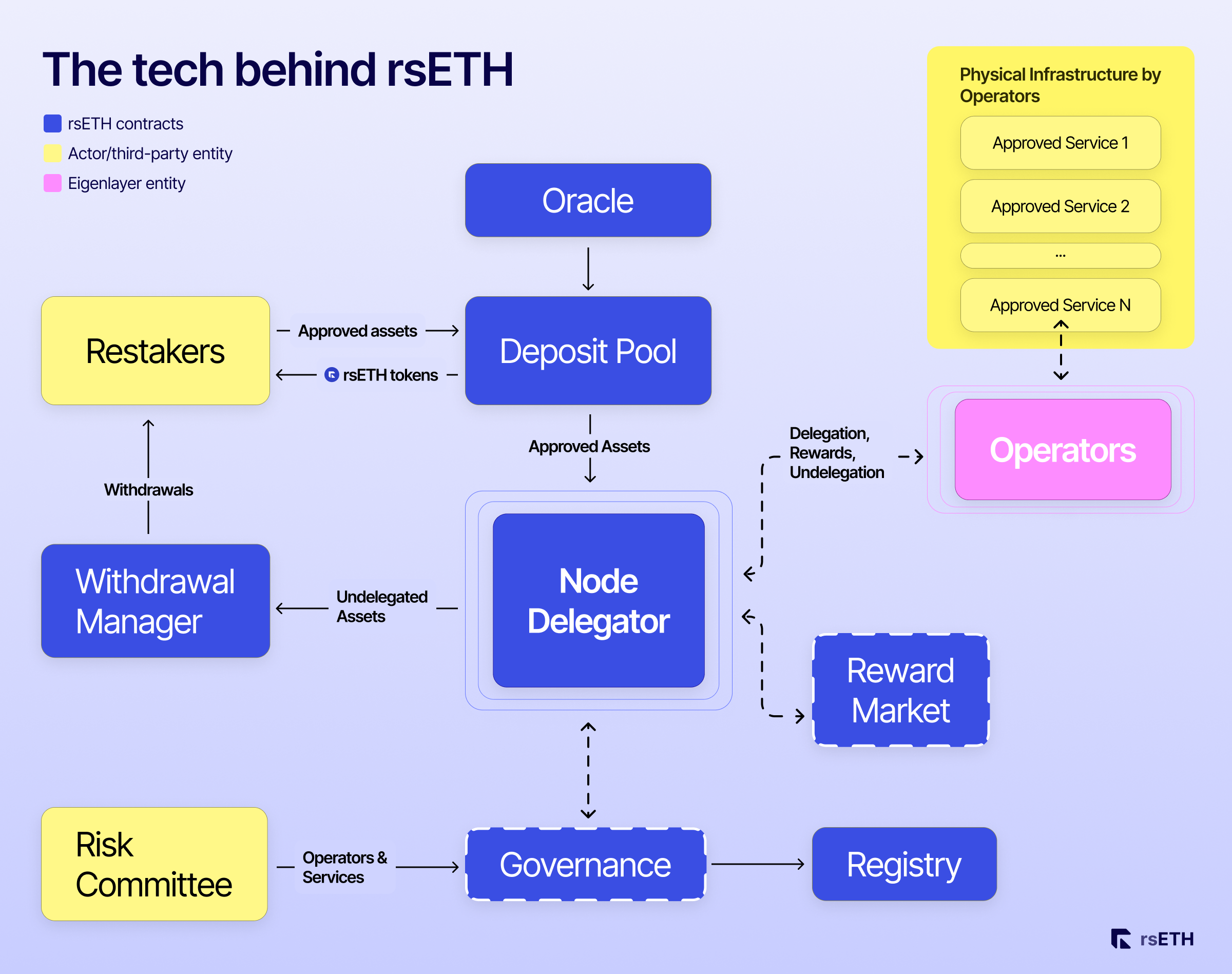

The main modules that power rsETH are the deposit pool, node delegator, reward market and withdrawal manager contracts.

The deposit pool is a simple vault that allows restakers transfer their liquid staked tokens and issues rsETH tokens back based on the current exchange rate of rsETH.

The deposit pool further ensures delegation of these liquid staked assets from restakers into different operators working with the LRT DAO to act as economic security for AVS’ keen to build on Eigenlayer. In short, the deposit pool offers a simplified version of restaking for a restaker abstracting the complexity of rewards, validator delegation etc.

The node delegator module does the heavy lifting of moving the deposited liquid staked assets to contracts for each operator. Assets in each node delegator are delegated to one operator thereby providing the economic security of the delegated assets to all nodes that an operator chooses to operate for different AVS’. Node delegators also claim rewards, engage in prescribed strategies for different rewards thereby automating reward redemption process for restakers enabling major gas savings.

Reward market provides various strategies that different rewards can be engaged in. These decisions will be driven by DAO through governance. A reward market helps AVS’ avoid undesired token activity while helping restakers obtain better returns. The reward market will be the foundational layer for all rewards accrued through restaking.

Withdrawal Manager module helps rsETH holders convert their rsETH tokens into a share of all assets managed by the protocol. Redeemers can expect to receive a complex set of various rewards received by Node Delegators for delegating to operators subscribed to various AVS’.

A high level flowchart is provided in the illustration below.

rsETH security roadmap

Security is of the utmost importance to a fundamental DeFi primitive like an LRT.

rsETH rollout will happen in the following phases.

- Audits: rsETH will be rigorously audited by popular security auditors in the upcoming weeks.

- Testing: Prior to the mainnet launch, rsETH will face extensive testnet testing to bootstrap the ecosystem.

- Bounties: Inline with the security theme, whitehats can find our code to verify and review with potential to earn bounties for bugs.

What’s next?

In the coming weeks, we plan on sharing the following with the Ethereum community:

- rsETH litepaper

- rsETH roadmap

- Stader’s LRT contract audit reports

- Incentives for early liquid restakers

Conclusion

rsETH promises to unlock greater utility and capital efficiency to users. To never miss an update, sign up for our mailing list and be the first to know about exclusive incentives. All announcements are first made on the Stader Ethereum Twitter page. For any questions you might have, hop onto our Discord.

Until the next time, check rsETH out. Now live on testnet!