Introducing sFTMx

Home

Blogs

Fantom

Introducing sFT...

Introducing sFTMx

Dear Fantom Fam,

As discussed in our vision with Staking on Fantom here, Stader is launching Liquid staking for Fantom in the next 2 weeks. We are excited to be sharing more details on our liquid token sFTMx as we gear up for launch.

Read on for further details:

1. sFTMx: Top highlights

2. How does sFTMx work?

Part 1: Staking

Part 2: Liquidity for sFTMx

Part 3: Decentralization

3. Launch details

1. sFTMx: Top highlights

- ~13.5%+ APY: sFTMx will deliver maximum staking rewards, typically reserved for 365 day lock-ins, while also allowing for instant liquidity on DEXs

- Max DeFi interoperability: sFTMx’s cToken design allows for easy integration with all types of DeFi prtocolos — from DEXs to Lending/ Borrowing protocols to Yield Optimizers (from vaults to auto-compounders to leveraged yield farming). This means the staking rewards are only the beginning of sFTMx’s potential.

- Conscious Decentralization: When you stake with Stader, your assets are automatically distributed across a carefully chosen set of validators. This furthers Fantom decentralization while minimizing slashing risks.

2. How does sFTMx work?

Part 1: Staking

sFTMx will be a cToken that increases in value relative to FTM as staking rewards accrue. Users will have the ability to stake their FTM through Stader’s dApp and mint a new liquid token — sFTMx . sFTMx <> FTM exchange rate will be initialized as 1 at the start of the contract. Every time staking rewards are added to the pool the sFTMX <> FTM exchange rate will increase using the formula

New sFTMx <> FTM exchange rate = (Current sFTMx <> FTM exchange rate) + (rewards added) / (Total sFTMx in circulation)

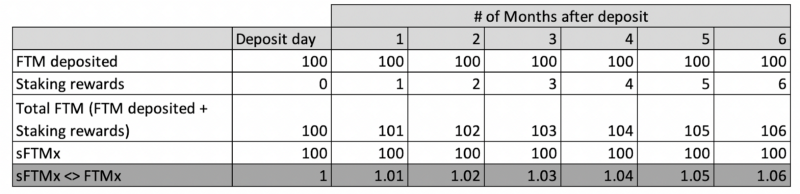

The following table illustrates how sFTMx value grows with staking rewards (for simplicity, 1% rewards per month is showcased below):

When users stake FTM, they will mint sFTMx at the prevailing exchange.

All FTM staked with Stader will be locked-in for 12 months and rolled over for the next 12 months upon maturity. This will allow us to maximize the rewards for users while still providing opportunities to exit the position if they so choose. We will also auto-compound all rewards every 5 days on average to maximize APY.

Part 2: Liquidity for sFTMx

There are two routes of liquidity available for users:

- Liquidity pools: FTM <> sFTMx liquidity pools on top DEXs to provide instant liquidity to users who want to exit their sFTMx positions.

2. Unstaking with Stader:

- Unstake request within “Free pool”: While we lock-in FTM deposits and maturing flows to 12 month lock-in to maximize yield for our users, we have designed a mechanism to allow for a pool from which users can unstake for free. To do this, we will hold new deposits and maturing funds (after lock-in expiry) for ~5 days before staking and locking them. This dynamic reserve will constitute the “Free pool”. When withdrawal requests are within this limit, users will get FTM as per the prevailing sFTMx <> FTM exchange rate while the sFTMx will be burned.

- Unstake request beyond Free unstake pool: In this case, FTM is given back to user, while sFTMx gets burned, after deducting a small penalty on the prevailing sFTMx <> FTM exchange rate as we unstake prematurely and lose accrued rewards due to early unlock in line with Fantom’s native staking.

All unstaking will be followed by a mandatory 7 day unbounding period before being available for withdrawal in line with the underlying native staking contracts.

Part 3: Decentralization

Stader enables single-click staking with a carefully curated pool of validators. Validators will be chosen based on:

- Previous history of safety (example parameters include Time since launch, zero slashing, social/community presence)

- Performance (such as zero downtime)

- Relatively low share of delegations to help decentralization

More details on the validator selection criteria to be shared soon in another blog post.

3. Launch Details

We are going into beta testing next week and should be having our official launch in about 2 weeks. We can’t wait to kickstart the Liquid staking revolution on Fantom!

Please follow us on Twitter for exclusive launch updates

By:

Stader Labs

Join Stader’s newsletter

Get the latest updates, new DeFi strategies and exclusive offers right in your email box

Analytics

© Copyright 2023 Stader. All rights reserved.